Clover and CardPointe

Low-cost payment processing solutions

Offer expires in:

Online and offline payment processing solutions for every small business & startup

Included in our Growth and Enterprise accounting packages

Click the images below to discover the ideal solution for your business.

Payment-ready power: Clover's all-in-one POS features

Clover POS hardware

Comprehensive range of devices including Clover card readers, cash drawers, receipt printers, and barcode scanners.

Clover POS software

Robust software for efficient transaction processing, inventory and sales management, order taking, and billing.

Clover real-time inventory management

Dynamic tools for accurate tracking of stock levels, order management, and supplier coordination.

Clover integrated payment solutions

Accept credit card payments. Seamless processing of various payment types, including credit, debit, contactless, and mobile payments.

Clover CRM functionality

Enhanced customer relationship management to track interactions, purchase history, and preferences for superior service.

Clover employee management tools

Efficient staff management with scheduling, time tracking, and role-specific access to POS functions.

Clover insightful reporting & analytics

Detailed reports providing insights into sales trends, inventory, employee performance, and

customer data.

Clover loyalty & gift card options

Easy implementation of loyalty programs and gift card management, boosting customer engagement and retention.

Remove the hassle of managing multiple systems

Simplify payment acceptance, integration, and management with CardPointe platform.

CardPointe secure payment pages

Customizable and secure payment pages for a seamless and safe online checkout experience.

CardPointe fraud management

Advanced features to detect and prevent fraudulent transactions, safeguarding both merchants and customers.

CardPointe mobile payment

Flexible solutions for accepting payments via mobile devices, ideal for various business environments.

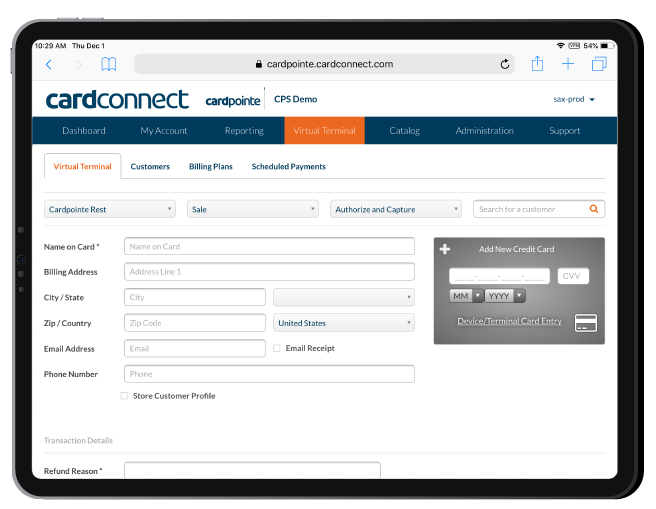

CardPointe virtual terminals

Convenient web-based terminals for manual entry of payment card details, suitable for phone or mail orders.

Point-to-point encryption

Full encryption of cardholder data from the initial transaction point to the payment processor.

Credit card tokenization

Enhanced security with tokenization technology, reducing credit card fraud risks.

API integration

Integration with e-commerce platforms, CRM systems, and accounting software through robust APIs.

Global transaction support

Multi-currency and international transaction capabilities, catering to

a worldwide customer base.

Clover and CardPointe payment processing solutions are included within Otterz's Growth and Enterprise packages

Clover and CardPointe Services: Frequently Asked Questions

-

Can the Point-of-Sale Clover solutions process various payment types?

Clover POS systems are recognized for their flexibility in accepting various payment options, making them an ideal choice for small businesses. They support:

- Cash

- Checks

- Credit cards

- Debit cards

- Prepaid cards

- Gift cards

- EBT cards

- Custom tenders

- Alipay®

Notably, credit and debit cards, including those enabled with contactless technology, can be easily used with Clover devices. Furthermore, Clover systems integrate seamlessly with mobile wallets like Apple Pay®, Samsung Pay®, and Google Pay™, enhancing the contactless payment experience for small businesses.

-

How does the Clover Point-of-Sale solutions assist with inventory management?

The Clover Point-of-Sale (POS) solutions significantly enhance inventory management by providing a comprehensive suite of tools and features designed for strategic inventory control and sales enhancement. Here's how Clover POS assists in different facets of inventory management:

Strategic Inventory Management

- Efficient Tracking: Clover POS ensures that understanding and managing what's in stock goes beyond mere logistics. It provides nearly flawless inventory management capabilities, allowing businesses to keep track of their stock levels accurately.

- Sales Strategies: It guides in deploying effective strategies to move inventory, including creating attractive product displays, timing discounts appropriately, and developing strategies for items that are challenging to sell.

Sales and Marketing Tactics

Clover POS offers insights on:

- Creating displays that drive sales.

- Selling perishable items swiftly or finding ways to repurpose them if they can't be sold.

- Managing slow-moving products by devising specific strategies to enhance their sell-through.

- Strategic discounting and clearance sales to optimize inventory turnover without sacrificing profit margins.

- Upselling: Training staff on techniques to increase the average transaction value, thereby moving more products and enhancing customer satisfaction.

Leveraging Big Data

- Real-Time Insights: With Clover POS, businesses gain access to real-time sales data, allowing for immediate adjustments to sales strategies and inventory levels.

- Data-Driven Decisions: The system provides detailed performance reports on products, helping businesses decide when to discontinue a product or adjust the product mix.

- Market Responsiveness: Real-time data aids in quickly responding to market changes, ensuring businesses can adapt their inventory and sales strategies on the fly.

Planning for Growth

- Forecasting and Strategy: The data collected and analyzed by Clover's advanced inventory management systems aid in developing detailed projections for future growth, helping businesses to strategically expand their product lines or enter new markets.

- Expansion Timing: Clover's insights help determine the best times to open additional locations or expand the business footprint based on solid, data-driven rationale.

Clover POS systems offer more than just inventory tracking; they provide a strategic toolkit for enhancing sales, optimizing inventory management, and planning for growth. By leveraging real-time data, detailed analytics, and strategic sales techniques, businesses can not only manage their inventory more effectively but also achieve smarter, data-informed growth.

-

Do the Clover solutions include Customer Relationship Management (CRM) features?

Yes, Clover solutions come equipped with integrated Customer Relationship Management (CRM) features tailored for small businesses that are serious about their growth. This suite of CRM tools is designed to help you deepen and nurture your customer relationships over the long term, directly through the Clover POS system.

Key CRM Features in Clover Solutions

Understanding Your Customers: Clover's CRM system enables you to convert new customers into repeat visitors by tracking their purchase behaviors, identifying loyal patrons, and understanding their buying preferences.

Engaging Your Customers: With the ability to create and send out promotions for popular items, Clover helps you maintain a connection with your customers, encouraging them to return.

Rewarding Loyalty: The system includes functionalities for setting up and managing customer loyalty programs, allowing you to reward your most loyal customers and make them feel valued.

Collecting Feedback: Clover provides a direct channel for receiving customer feedback, bypassing public social media and review platforms for more private and constructive communication.

Additional CRM Benefits

Customer Profiles: Automatically generate customer profiles from credit card transactions, enriching these profiles over time for a comprehensive view of your customer base.

Up-to-Date Information: Keep your client contact details and marketing preferences current with Clover’s CRM tools.

Discover Your Advocates: Identify and get to know your best customers through their profile photos, purchase history, and loyalty program tier.

Customizable Rewards Programs: Develop and execute custom, data-driven rewards programs directly through your Clover system, with no extra hardware required.

Promotion and Engagement: Utilize the CRM system to easily promote your rewards program across various channels, including social media, with just a tap.

Simplifying Rewards: Enable customers to engage with your rewards program through an app available for both iPhone and Android devices, making loyalty both simple and enjoyable.

Personalized Promotions: Tailor promotions to customer segments based on their preferences and purchase history, and re-engage customers who haven't visited in a while with special incentives.

Direct Feedback: Proactively solicit feedback through digital receipts, engage with customers one-on-one in a private setting, and show appreciation for their input to foster trust and loyalty.

Clover’s CRM capabilities are designed not just for transaction processing but to enhance the overall customer experience, from recognizing and rewarding loyalty to engaging in meaningful feedback loops. This comprehensive approach aims to transform customers into loyal fans, contributing to the sustainable growth of your small business.

-

What kind of reporting and analytics capabilities do the Clover POS solutions offer?

Clover POS solutions offer insights into your business operations, empowering you with the data needed to drive growth and efficiency. Users can easily identify their top-performing products, busiest times, and most effective team members through Clover's advanced sales tracking system. This platform simplifies tax preparation by providing access to essential POS reports that can be directly handed off to an accountant or integrated with accounting software like QuickBooks, streamlining the tax filing process.

With Clover, businesses can customize management reports to align with their specific needs, facilitating informed decision-making to enhance overall performance. At the end of each day, Clover delivers comprehensive reports detailing gross sales, refunds, tips and server totals, and credit card transactions broken down by card type, offering a complete snapshot of the day’s operations.

Clover's system is designed for ease of use, allowing for seamless data download or integration with popular accounting apps such as QuickBooks® and Xero. This automated integration reduces the likelihood of data entry errors and saves time by eliminating the need for manual updates to financial records.

-

Is there ecommerce integration available with the Clover POS systems?

Yes, Clover POS systems come equipped with powerful eCommerce integration capabilities, designed to propel your online business to new heights. With Clover, you can effortlessly merge your current website with our comprehensive eCommerce solutions or take advantage of our expertise to develop a brand-new online presence. Central to managing your digital and physical storefronts is the Clover® Dashboard, a unified platform where you can oversee all aspects of your business in one convenient location.

Clover's eCommerce solutions are engineered to boost your productivity by keeping everything in sync. This means your orders, inventory, and customer data are consistently updated across all sales channels, eliminating discrepancies and ensuring smooth operations. Whether you're looking to accept orders, process payments, establish a webstore, or enable online appointment bookings, Clover's system is customizable to fit your specific business requirements.

All your sales channels are managed through a singular, unified dashboard, granting you access anytime, anywhere — whether you're on the web or using a mobile device. This integrated approach ensures that every part of your business, from in-store sales to online orders, works in harmony.

Security is paramount in the digital realm, and Clover takes it seriously. Enjoy the peace of mind that comes with knowing your transactions and customer data are protected with advanced security measures. Clover's eCommerce solutions offer a safe and secure environment for your online transactions, giving you and your customers confidence with every sale.

-

What are the features and benefits of the Clover Mini?

The Clover Mini is an advanced, compact point-of-sale (POS) system that brings a wealth of features and benefits to small businesses looking to streamline their payment processes and business management. With its large 8" touchscreen, the Clover Mini provides ample space for confirming orders, completing payments, and managing business operations with ease and efficiency.

One of the standout features of the Clover Mini is its ease of payment. Customers can quickly dip or tap their cards using the conveniently placed card slot and contactless reader. Additionally, the Clover Mini offers versatility in receipt options, allowing customers to choose between printed receipts from the built-in printer or digital receipts sent via email or text.

The Clover Mini supports a wide array of payment options, including swipe, dip, or tap for credit or debit cards, along with contactless payments such as Apple Pay®, Google Pay™, and PayPal/Venmo®, catering to the varied preferences of your customers. Its capability for anywhere, anytime access ensures you have 24/7 real-time access to your data, allowing you to manage your business remotely.

Designed to grow with your business, the Clover Mini is compatible with all other Clover devices. It can be expanded with accessories to build a complete system, ensuring that as your business evolves, your POS system can too, without missing a beat.

In terms of inventory and sales management, the Clover Mini excels with features that keep your inventory organized and sales information updated in real-time. This includes categories, labels, modifiers, and variants for inventory, as well as the ability to monitor transactions, hourly sales, and top-selling items. The system also enables taking payments away from the counter, including card-not-present transactions and setting up recurring payments for repeat business.

Beyond its robust POS functionalities, the Clover Mini helps turn customers into loyal fans with its built-in capabilities to create engaging loyalty programs. It also offers Clover Capital, which can turn future credit card sales into working capital, providing a fast and easy funding solution. The system’s ability to connect with best-in-class apps, such as Quickbooks for accounting, BigCommerce for eCommerce, and Homebase for staff scheduling, further enhances its utility for small businesses.

With end-to-end encryption for security, Wi-Fi, ethernet, and LTE connectivity options, and an optional cash drawer add-on, the Clover Mini is a comprehensive solution designed to meet the diverse needs of small businesses, offering a seamless blend of payment processing, business management, and growth support.

-

What Mobile Payment Solutions does Clover offer for small businesses?

Clover provides an exceptional mobile payment solution tailored for small businesses with its Clover Go system. This portable credit card reader, when paired with your smartphone, enables you to process payments wherever your business takes you, be it at pop-up locations, outdoor markets, or client sites. With the capability to connect via WiFi or cellular internet, Clover Go ensures you have the power of a full POS system in the palm of your hand, anytime and anywhere.

The Clover Go solution is designed for ease and flexibility. The accompanying app is straightforward to download and intuitive, allowing for quick setup and immediate use. It offers flexible order management features, such as the ability to open, edit, and delete items or take payments at a later time without needing to start over. Its one-touch tipping and efficient handling of refunds, returns, and exchanges make transactions smooth for both you and your customers.

Moreover, Clover Go helps small businesses save on transaction fees by offering lower card-present rates when paired with the Go reader, supporting both chip and tap payments. It accepts all major credit and debit cards, along with mobile wallet and contactless payments, including Tap-to-Pay on iPhone, ensuring you never miss a sale due to payment type restrictions.

Clover Go's compatibility with both iOS and Android devices, including optimization for Apple iPad screens, ensures it fits seamlessly into your business operations, regardless of the mobile technology you use. You can customize your business settings directly through the POS dashboard on your mobile device, including discounts, tips, tax rates, and service or delivery charges, for a personalized customer experience.

All activities conducted through Clover Go are synchronized with your Clover Dashboard, enabling you to manage your business from anywhere. This integration provides a comprehensive view of all transactions, whether they're processed through the mobile Clover Go app, the reader, or any other Clover device, ensuring you have full insight into your business's financials on the go.

-

What advantages does the Clover Flex offer to businesses needing flexibility and mobility?

The Clover Flex stands out as a handheld POS system that brings unmatched flexibility and mobility to businesses of all sizes. Designed to operate both as a standalone system and alongside other Clover devices, it encapsulates the essence of a full POS system within its portable frame, making it an ideal choice for businesses constantly on the move or those requiring versatility in payment and management processes.

Portability and Comprehensive Features: With a compact design featuring a ~6" touchscreen, built-in printer, camera, and barcode scanner, the Clover Flex empowers businesses to conduct tableside ordering, on-the-spot payments, and real-time inventory checks. Its ability to swipe, dip, tap, and accept contactless payments makes transactions seamless, wherever your business takes you.

Seamless Integration: The Clover Flex shines in its capacity to function splendidly on its own or as part of a broader Clover system setup. This flexibility allows for tailored business solutions, whether operating a mobile service, a pop-up store or integrating it into a fixed business location for enhanced service delivery.

Effortless Setup and Use: Geared for immediate use right out of the box, the Clover Flex requires minimal setup and training, allowing businesses to hit the ground running without delay. This ease of use extends to its cloud-based infrastructure, offering businesses the ability to access data and run operations from anywhere, ensuring you're always connected to your business.

Customization and Control: The Clover Flex does not compromise on power or versatility despite its size. It offers the same customization options as larger Clover devices, allowing businesses to tailor the system to their specific needs. From tracking sales and managing inventory with advanced categorization to monitoring team performance and setting permissions, the Clover Flex provides a comprehensive overview of your business operations.

Enhanced Customer Engagement: Beyond its operational capabilities, the Clover Flex aids in transforming customers into loyal fans through the creation of engaging loyalty programs. It also facilitates rapid deposits, ensuring businesses have access to their funds whenever needed, and offers Clover Capital for easy access to working capital based on future credit card sales.

Robust Build and Connectivity: The device boasts an impressive battery life of at least 8 hours, ensuring reliable performance throughout the business day. Its connectivity options, including WiFi and LTE, along with secure end-to-end encryption, ensure transactions are not only versatile but also secure.

In summary, the Clover Flex is a powerful tool for businesses seeking a mobile, flexible, and efficient POS solution. Its comprehensive features, combined with the ability to customize and control business operations remotely, make it an invaluable asset for businesses aiming to adapt, grow, and thrive in any setting.

-

What makes the Clover Station Solo a good choice for small businesses?

The Clover Station Solo emerges as a premier choice for small businesses seeking an all-in-one point of sale (POS) solution that combines ease of use with comprehensive functionality. Designed with small business needs in mind, the Station Solo offers a suite of features that streamline operations, enhance customer service, and provide valuable insights into business performance.

Comprehensive Workstation: The Station Solo boasts a 14" high-definition touch screen, providing ample space for efficient work management, including inventory, employee management, payments, and reporting. This large display ensures tasks are completed quickly and easily, enhancing the overall user experience.

Ready to Use: Out of the box, the Clover Station Solo comes equipped with a cash drawer and receipt printer, eliminating the need for additional hardware purchases. This ready-to-use setup allows businesses to get up and running without any hassle.

Enhanced Team Communication: With features designed to sync communication between staff and back-of-house operations, the Station Solo enhances the way your business runs, ensuring everyone is aligned and informed.

Scalable Solution: The ability to seamlessly integrate with every other Clover device means the Station Solo can grow alongside your business. This scalability ensures that as your business expands, your POS system can adapt without skipping a beat.

Simplified Payments: Accepting swipe or dip payments from all major credit cards, the Station Solo makes transactions easy for both your business and your customers, supporting a smooth checkout experience.

Robust Performance: Packed with processing power, the Station Solo delivers speed, reliability, and efficiency, helping you run your business more effectively.

Remote Business Management: The Station Solo puts your data to work, offering tracking and reporting capabilities that provide insights into sales patterns and trends. Manage your staff with tools to track performance, schedules, and hours, and set system permissions to maintain security and oversight.

Versatile Payment Options: Even when away from the counter, the Station Solo provides options for customers to pay, including Clover Virtual Terminal, invoicing, and recurring payments, ensuring business continuity and convenience.

Financial Growth Tools: Features like Clover Rapid Deposit and the ability to turn future credit card sales into working capital underscore Station Solo’s role in supporting your business's financial health and growth.

Customer Engagement: The addition of gift card options, both digital and physical, serves as a strategy to drive immediate sales and attract new customers, fostering growth and brand loyalty.

Security and Connectivity: With Clover's end-to-end encryption, businesses can rest assured their data is secure. The inclusion of WiFi, ethernet, and 4G/LTE connectivity options ensures uninterrupted operations, while the cash drawer and dual camera setup add to the Station Solo’s functionality and security.

In essence, the Clover Station Solo stands out as an invaluable tool for small businesses, providing a robust, intuitive, and scalable POS solution that supports every aspect of business operations from sales to staff management and customer engagement.

-

In what ways does the Clover Station Duo enhance customer interactions and transactions?

The Clover Station Duo significantly enhances customer interactions and transactions through its innovative dual-screen design, comprehensive payment options, and integrated customer engagement tools. This system not only streamlines the transaction process but also enriches the overall customer experience in several key ways:

Dual-Screen Efficiency: The Station Duo features a 14" high-definition merchant-facing touch screen paired with an 8" customer-facing touch screen. This dual-screen setup facilitates faster checkouts by allowing customers to confirm orders, leave tips, redeem rewards, pay, and request digital receipts simultaneously, keeping lines moving smoothly and reducing wait times.

Intuitive Design and Ease of Use: Combining attractive hardware with user-friendly software, the Station Duo is designed for simplicity and speed. The system comes ready to use out of the box, requiring minimal staff training, thus ensuring that interactions with customers are smooth and professional from day one.

Versatile Payment Options: The Station Duo accepts all major forms of payment, including credit or debit cards, swipe, dip, and contactless payments such as Apple Pay®, Google Pay™, and next-generation payments like PayPal/Venmo® QR codes. This flexibility allows customers to choose their preferred payment method, enhancing their overall experience.

Advanced Security Features: With Clover's end-to-end encryption and integrated chip sensors, the Station Duo ensures that every transaction is secure, protecting both business and customer information and building trust with your customers.

Remote Business Management: The ability to track sales, manage inventory, and view reports on business performance from anywhere gives merchants the insights needed to make informed decisions. This, coupled with tools to manage staff schedules, permissions, and performance, ensures that the business runs smoothly, indirectly enhancing customer service.

Integrated Customer Loyalty Programs: The Station Duo helps businesses grow a customer list automatically from credit card sales and enables the creation of tailored rewards programs. This makes it easier to recognize and reward your best customers, fostering loyalty and encouraging repeat business.

Targeted Promotions: With the Station Duo, businesses can easily offer promotions on new or seasonal items, directly engaging customers with relevant offers that enhance their shopping experience.

Comprehensive Connectivity: Featuring WiFi, ethernet, and 4G/LTE connectivity, the Station Duo ensures that businesses stay connected, transactions are processed quickly, and customer interactions are never interrupted due to connectivity issues.

In essence, the Clover Station Duo offers a powerful combination of speed, security, and flexibility, designed to enhance every step of the customer transaction process. Its innovative features not only make transactions more efficient and secure but also enable businesses to build stronger relationships with their customers through personalized experiences and loyalty rewards.

-

How does Clover support customer loyalty and engagement programs?

Clover offers a robust platform for fostering customer loyalty and engagement, providing businesses with the tools to create a compelling loyalty program that rewards customers in meaningful ways. The Clover Rewards system is an integral part of this offering, enabling businesses to design a unique loyalty program that enhances customer retention and spending.

Enhanced Customer Spending and Retention: Research shows that customers engaged with loyalty programs tend to spend 60% more per transaction, make purchases 90% more frequently, and are five times more likely to choose the same brand in the future. Clover leverages these insights, offering businesses the ability to encourage larger spends and more frequent visits from their customer base.

User-Friendly Experience: The Clover mobile app plays a crucial role in the loyalty program, making it easy and convenient for customers to track their points and for businesses to recognize loyal customers in real-time. This seamless integration between the POS system and the mobile app ensures a fun and engaging experience for customers, encouraging their participation in the loyalty program.

Preloaded and Easy to Launch: Clover Rewards comes preloaded on the Clover system, making it straightforward for businesses to launch and manage their loyalty programs directly from their POS. This ease of setup and use means businesses can start rewarding their customers without any additional investment in software or complicated setup processes.

Customizable Offers and Automatic Enrollment: Businesses can tailor their loyalty programs to fit their specific needs, creating various perks to attract a wider customer base. Customers can easily enroll at the counter or via the Clover mobile app, with every receipt serving as a reminder to join the program. Points are awarded automatically based on purchase amounts or specific inventory items, ensuring a fair and transparent rewards system.

Direct Redemption at Checkout: When customers earn a reward, they receive a notification and can redeem their perk directly at checkout, enhancing the customer experience. Businesses can also proactively add perks to orders, personalizing the shopping experience further.

Clover Mobile App: Beyond loyalty points, the Clover mobile app offers customers the ability to order ahead and use autopay, putting your business right in their pocket. This app not only facilitates the loyalty program but also streamlines transactions, making it faster and more convenient for customers to interact with your business.

Comprehensive Engagement Solutions: For businesses seeking to amplify their customer engagement efforts, Clover offers the Customer Engagement Plus plan. This plan includes unlimited outreach, targeted promotions, birthday rewards, automated win-back campaigns, and much more, providing a powerful toolkit for engaging customers and driving loyalty for a monthly fee.

In summary, Clover supports customer loyalty and engagement through a comprehensive suite of tools designed to enhance customer experiences, increase spending and frequency of visits, and create lasting relationships between businesses and their customers.

-

Can the CardPointe solutions process various payment types?

Cardpointe offers a comprehensive suite of payment processing tools that enable small businesses to accept:

- Credit cards

- Debit cards

- Contactless cards (NFC)

- EMV chip cards

Payments can be processed through a variety of CardPointe's solutions, including POS devices, virtual terminals, and mobile apps. This ensures small businesses can accept payments in whichever format is most convenient for their customers, from in-store transactions to online payments and mobile sales.

-

Is there ecommerce integration available with the CardPointe platform?

Yes, the Cardpointe platform offers comprehensive eCommerce integration solutions, designed to cater to the diverse needs of businesses seeking to enhance their online payment processes. Through the CardPointe Gateway, merchants have access to a suite of tools and resources to integrate eCommerce payments seamlessly into websites or applications.

Hosted and Customizable Solutions: The platform features both hosted solutions, like the Hosted Payment Page (HPP) and Hosted iFrame Tokenizer, and the option for custom integrations using the CardSecure API alongside the CardPointe Gateway API. These offerings are tailored to minimize development efforts while ensuring a secure and compliant payment environment.

Simplified Payment Integration: With the Hosted iFrame Tokenizer, businesses can embed a secure payment form directly into their websites with minimal development work, capturing and encrypting sensitive cardholder data. The HPP further simplifies the integration process by providing a complete payment solution with a customizable user interface that can seamlessly blend into your existing website design.

Enhanced Security and Compliance: By handling all sensitive cardholder data securely and ensuring it never touches your systems, both the HPP and Hosted iFrame Tokenizer significantly reduce the PCI compliance burden on merchants.

Comprehensive API Support: For those requiring a more tailored eCommerce experience, the CardSecure API allows the development of custom tokenizers that meet specific business needs. This, combined with the CardPointe Gateway API, enables merchants to create and manage customer profiles, process payments, and access detailed transaction reports.

Digital Wallet Integration: The platform also supports digital wallet payments, including Apple Pay and Google Pay, through its Mobile SDKs and API integrations. This addition allows customers to make quick and secure payments using their stored digital wallet information, enhancing the checkout experience.

Versatile Payment Processing: Beyond the integration capabilities, the platform enables authorization, capture, void, and refund of payments, and the creation and management of customer profiles, providing a comprehensive toolkit for managing online transactions.

In summary, the Cardpointe platform offers a robust and flexible solution for eCommerce integration, supporting a variety of payment processing and management functions that cater to the needs of modern online businesses.

-

How does CardPointe ensure transaction security and compliance?

CardPointe maintains the highest standards of transaction security and compliance, ensuring that merchants can confidently process payments while safeguarding their customers' sensitive payment information. Through its CardPointe Gateway, the platform achieves this by adhering to and facilitating compliance with essential payment industry standards and regulations.

Compliance with Payment Industry Standards: The CardPointe Gateway is rigorously certified to comply with the latest Payment Card Industry Data Security Standards (PCI DSS). This certification demonstrates CardPointe's commitment to maintaining a secure environment for processing, storing, and transmitting credit card information.

Advanced Encryption and Tokenization with CardSecure: At the core of CardPointe's security measures is CardSecure, a sophisticated service that encrypts and tokenizes sensitive payment data. This includes payment card information, ACH (eCheck), and mobile wallet data. By converting this data into secure tokens, CardSecure ensures that sensitive cardholder information is never exposed to merchant systems or applications, significantly reducing the scope of PCI compliance for merchants.

Adherence to Visa and Mastercard Requirements: CardPointe also complies with the Visa and Mastercard Stored Credential Transaction Framework Mandate. This mandate requires merchants to obtain consent from cardholders for storing their payment details and to correctly identify transactions using stored credentials. Compliance with this mandate is crucial for merchants who store cardholder data to facilitate repeat transactions.

Support for 3-D Secure Protocols: For merchants operating in regions with specific e-commerce payment security requirements, such as the European Union, India, and Australia, CardPointe supports 3-D Secure (3DS) protocols. 3DS is a security standard developed to add an additional layer of authentication for online credit and debit card transactions, aligning with the Strong Customer Authentication (SCA) requirements in the European Union. The CardPointe Gateway supports 3-D Secure 2.0, enabling merchants to comply with these regional mandates and enhance the security of e-commerce transactions.

In addition to these specific measures, CardPointe provides merchants with access to resources and best practices for securing e-commerce, as recommended by the PCI Council. This comprehensive approach to security and compliance ensures that merchants can focus on growing their businesses, confident in the knowledge that their transactions are secure and compliant with the latest industry standards.

-

What are CardPointe Hosted Payment Pages and how do they integrate with ecommerce sites?

CardPointe Hosted Payment Pages (HPP) offer a secure, streamlined solution for businesses looking to collect payments online through credit cards and e-check. These hosted pages are designed to integrate seamlessly with your eCommerce site, providing a straightforward and safe checkout experience for your customers.

Seamless Integration and Customization: The CardPointe HPP can be easily integrated into your existing website, invoicing system, or mobile platform with minimal effort. It includes customizable buttons such as "Pay Now," "Buy Now," or "Donate," which link directly to a PCI-compliant payment page, reflecting your company’s branding with logos and design elements. This customization extends to design options, including fonts, colors, and the addition of custom fields, ensuring a consistent user experience that matches your brand identity.

Enhanced Security and Compliance: Utilizing the CardPointe HPP significantly reduces your PCI-DSS scope since sensitive payment data is processed and stored securely by CardPointe, not on your systems. This feature, coupled with advanced security measures like tokenization and double encryption of credentials, protects both your business and your customers from potential security risks.

Convenient Features for Businesses and Customers: The HPP is equipped with features designed to enhance the payment process, including:

ReCAPTCHA Verification: Ensures that payment submissions are made by humans, not bots, enhancing security and accuracy.

Recurring Billing Plans: Allows businesses to set up and manage subscriptions or recurring payments with ease.

Multiple Merchant IDs (MIDs): Supports businesses with various cost centers, enabling the use of multiple MIDs on a single hosted plan.

Customizable Payment Confirmation and Receipts: Personalize the confirmation page and receipt options for a professional touch.

Real-Time Transaction Management: Access and manage transactions directly from the CardPointe platform, offering businesses immediate insight into their payment processing.

Mobile Optimization: Recognizing the importance of mobile transactions, the HPP is designed with a responsive form that automatically adjusts to fit any screen size, ensuring a user-friendly experience on both phones and tablets.

Integrations and Notifications: The HPP supports webhooks and email notifications, allowing for automatic updates to internal systems and timely payment confirmations to both customers and internal users. This integration capability ensures smooth operation within your existing business processes.

In summary, CardPointe Hosted Payment Pages provide a secure, customizable, and user-friendly payment solution for eCommerce sites, enhancing customer interactions while ensuring transaction security and compliance.

-

What is the CardPointe Credit Card Tokenization and how does it reduce fraud?

CardPointe Credit Card Tokenization is a security technology designed to protect sensitive credit card information during and after transactions. By converting credit card numbers into randomly generated sequences of characters known as tokens, tokenization significantly reduces the risk of credit card fraud and data breaches. These tokens can safely be stored, processed, or transmitted without exposing actual credit card details, thereby reducing the business's exposure to security risks.

How CardPointe Credit Card Tokenization Reduces Fraud:

Secure Data Handling: Since the tokens replace the actual credit card numbers in the business's systems, the sensitive data is never exposed to potential security vulnerabilities within the merchant's payment ecosystem. This means that even if a system is compromised, the attackers gain access to tokens rather than real credit card information, which are useless outside the specific transaction context.

Minimized PCI DSS Scope: Tokenization minimizes the scope of PCI DSS compliance by reducing the amount of cardholder data the business needs to protect. With less sensitive information to manage, businesses can more easily comply with industry standards for data security, further reducing the risk of data breaches and associated fraud.

Enhanced Customer Trust: By employing advanced security measures like tokenization, businesses can assure their customers that their credit card information is being handled with the utmost care. This not only helps in reducing fraud but also builds customer trust and loyalty, which is critical in today’s digital commerce environment.

Versatility Across Transactions: Tokenization is flexible and can be used for various transaction types, including online purchases, recurring payments, and card-on-file transactions. This versatility ensures that customer data is protected across all transaction modes, further reducing the opportunity for fraudulent activities.

Integration with Fraud Management Tools: Tokenized data can be integrated with other fraud management tools and practices, such as encryption and 3D Secure, providing a multi-layered security approach. This comprehensive strategy enhances the overall security of the payment process, significantly reducing the risk of fraud.

In summary, CardPointe Credit Card Tokenization plays a crucial role in modern payment security strategies by ensuring that sensitive credit card information is replaced with secure tokens. This process not only protects against the direct theft of card details but also reinforces the overall security infrastructure of businesses, contributing to a safer transaction environment for both merchants and consumers.

-

Can you explain Point-to-Point Encryption (P2PE) and its benefits?

Point-to-point encryption (P2PE) is a critical security measure that protects credit card data from the moment it is entered into a payment terminal until it reaches the payment processor's secure environment. In the context of CardPointe and its suite of payment processing solutions, P2PE plays a pivotal role in ensuring that sensitive payment information is encrypted throughout the entire transaction process, significantly reducing the risk of data breaches and fraud.

Benefits of P2PE in CardPointe's Context:

Enhanced Security: P2PE provides an additional layer of security by encrypting data at the point of entry (when the card is swiped, dipped, or tapped) and keeping it encrypted until it is decrypted in the secure, PCI-compliant environment of the payment processor. This means that the data is unreadable and thus protected against unauthorized access as it travels through various networks.

Reduced PCI Compliance Scope: By encrypting cardholder data at the point of interaction and ensuring it remains encrypted until it reaches CardPointe's secure decryption environment, P2PE greatly reduces the merchant's PCI DSS compliance scope. Merchants benefit from not having to implement and maintain as many costly and complex security measures themselves, as the sensitive data is protected by CardPointe's P2PE solution.

Mitigation of Fraud Risks: P2PE minimizes the risk of data being intercepted and decrypted by fraudsters during transmission. This significantly lowers the risk of fraudulent activities, such as counterfeit card fraud and identity theft, providing peace of mind for both merchants and their customers.

Streamlined Payment Processing: For businesses using CardPointe's payment processing solutions, P2PE integration means that payment data is securely and efficiently handled. This streamlines the payment process, making transactions quicker and more reliable, which can enhance the customer experience and improve operational efficiency.

Customer Trust: Implementing robust security measures like P2PE demonstrates a commitment to protecting customer data. This can enhance trust and loyalty among customers, who are increasingly concerned about the security of their personal and financial information in the digital age.

Future-Proofing: As payment technology evolves and cyber threats become more sophisticated, utilizing a P2PE solution through CardPointe ensures that businesses are at the forefront of payment security. This not only helps in meeting current compliance standards but also prepares businesses for future regulatory and technological shifts.

In essence, CardPointe's implementation of P2PE as part of its payment processing solutions offers businesses a powerful tool to secure payment data, reduce compliance burdens, and build customer trust, all while facilitating smooth and secure transaction experiences.

-

How do the Cardpointe Virtual Terminals work for payment processing?

The CardPointe Virtual Terminal is a browser-based payment processing solution designed to provide businesses with the flexibility to accept payments without the need for a physical credit card. This secure platform can be accessed via a desktop, laptop, or mobile device, making it an ideal solution for a wide range of transaction environments, especially for mail order or telephone order (MOTO) payments where the customer and the card are not physically present.

Key Features and How They Work:

Accessibility: The Virtual Terminal requires only a web browser and a CardPointe account to operate, allowing businesses to accept payments from virtually anywhere. This accessibility ensures that businesses can process transactions efficiently, regardless of their location or the customer's location.

Complimentary with CardPointe Account: The Virtual Terminal comes as a complimentary feature with a CardPointe account, providing significant value to merchants by integrating payment processing capabilities without additional costs.

Simplified Payments: It offers a streamlined solution for customers who prefer not to make payments online, allowing businesses to manually enter payment details received via mail or telephone. This flexibility ensures that merchants can cater to a broader customer base with varying payment preferences.

Secure Data Storage: The platform securely stores customer data, enabling features such as recurring billing, scheduled payments, and faster checkouts for return customers. This not only enhances the customer experience by making transactions more convenient but also helps businesses manage their billing processes more efficiently.

Advanced Security Features:

- Patented Tokenization: The Virtual Terminal utilizes tokenization to replace sensitive customer data with unique, irreversible tokens. These tokens are useless to hackers, thereby significantly reducing the risk of data breaches and fraud.

- Point-to-Point Encryption (P2PE): It can be integrated with PCI-validated, P2PE-enabled devices, offering an added layer of security by encrypting cardholder data from the moment of entry until it reaches the secure CardPointe environment. This end-to-end encryption protects data throughout its lifecycle.

- Simple Device Integration: For businesses that also handle in-person transactions, the Virtual Terminal seamlessly integrates with a range of secure, EMV-capable physical devices. This allows for a unified payment processing solution across different sales channels.

In summary, the CardPointe Virtual Terminal stands out as a versatile and secure solution for businesses looking to process payments efficiently, whether in person, over the phone, or via mail. Its combination of accessibility, security, and convenience makes it an invaluable tool for merchants aiming to provide flexible payment options while maintaining the highest standards of data protection.

-

What is the role of API Integration in the Cardpointe payment gateway?

API (Application Programming Interface) integration plays a crucial role in the CardPointe payment gateway by enabling seamless and secure communication between merchants' applications or websites and CardPointe's payment processing system. This integration facilitates a broad spectrum of payment operations, including the acceptance of various credit, debit, and alternative payment methods, directly within merchants' digital environments

-

Does Cardpointe support Multi-Currency and International Transactions?

All the payment processing solutions offered through CardPointe support transactions in multiple currencies and facilitate cross-country transactions. This feature caters to the needs of eCommerce businesses with a global customer base, ensuring that merchants can seamlessly accept and process payments from customers around the world.

For more specific information, please get in touch with us.

-

What features are available for Recurring Billing and Subscription Management?

CardPointe offers tools to efficiently manage recurring payments and subscriptions, essential for businesses that provide subscription-based products or services.

For more information, please get in touch with us.

Statistical Sources: National Association of Convenience Stores -

Credit Card Swipe Fees

Forbes Advisor -

Credit Card Processing Fees (2024 Guide)