How the New 2025 Tax Rules Impact LLCs, S-Corps, and C-Corps (Entity Comparison Guide)

Which Entity Structure Is Best for You in 2025?

As we dive into the second half of 2025, many business owners are asking, How will the new tax rules affect my business structure?

Whether you operate as an LLC, S-Corp, or C-Corp, the IRS has introduced some critical tax changes for 2025 that could impact your bottom line. Understanding these changes isn’t just about compliance; it’s about making smarter financial decisions for your business.

Here’s a simple, clear, and actionable guide to help you navigate the 2025 tax updates and choose the right entity for your business success.

Quick Overview: What Changed in 2025?

In 2025, the IRS introduced several new tax regulations affecting businesses of all sizes, including

● Updated corporate tax rates

● Changes in pass-through deductions

● New compliance requirements for entity owners

● Adjustments to self-employment taxes

● Extended tax credits and deductions for qualified businesses

Now, let’s break it down by entity type:

LLCs (Limited Liability Companies) in 2025:

Key Tax Changes:

- Qualified Business Income (QBI) Deduction Adjustment: The 20% QBI deduction for pass-through entities remains, but stricter limits apply for high-income LLC owners, especially in professional services like law, accounting, and consulting.

- Self-Employment Tax: LLC members still owe self-employment tax on their share of business profits. In 2025, the self-employment tax threshold increased slightly, but rates remain the same (15.3% combined Social Security and Medicare).

- SALT Deduction Limit Raised: The State and Local Tax (SALT) deduction cap increased from $10,000 to $40,000, a big benefit for LLCs in high-tax states.

Pros for LLCs in 2025:

- Flexible taxation (sole prop, partnership, or elect S-Corp)

- Pass-through tax benefits (with limitations)

- Less corporate compliance than C-Corps

Potential Downsides:

- Self-employment tax remains costly for profitable LLCs

- Complex reporting if electing S-Corp status

S-Corps in 2025:

Key Tax Changes:

- Pass-Through Income Rules Tightened:

High-earning S-Corp shareholders face new limits on the QBI deduction, similar to LLCs.

- Salary Requirement Enforcement:

The IRS has intensified scrutiny on reasonable compensation. S-Corp owners must pay themselves fair wages before taking distributions to avoid audits.

- Payroll Tax Compliance: No significant change here, but the IRS is enhancing enforcement of payroll tax deposits.

-

Pros for S-Corps in 2025:

● Potential to save on self-employment taxes with salary/distribution split

● Pass-through taxation (no double taxation)

● Stronger audit protection for payroll compliance

Potential Downsides:

● More rigid IRS rules for wages vs. distributions

● Complex tax filings (Form 1120S, K-1s)

C-Corps in 2025:

Key Tax Changes:

- Corporate Tax Rate Adjusted: The flat 21% federal corporate tax rate remains, but the IRS has hinted at stricter enforcement of deductions and credits.

- Double Taxation Still Applies: C-Corps continue to face taxation at both the corporate and shareholder dividend levels.

- Expanded Tax Credits: C-Corps now enjoy broader access to R&D tax credits and energy efficiency incentives, especially for tech, manufacturing, and clean energy industries.

Pros for C-Corps in 2025:

● Ideal for businesses reinvesting profits

● Access to unique tax credits and deductions

● Easier to raise capital through investors

Potential Downsides:

● Double taxation remains

● Complex corporate governance requirements

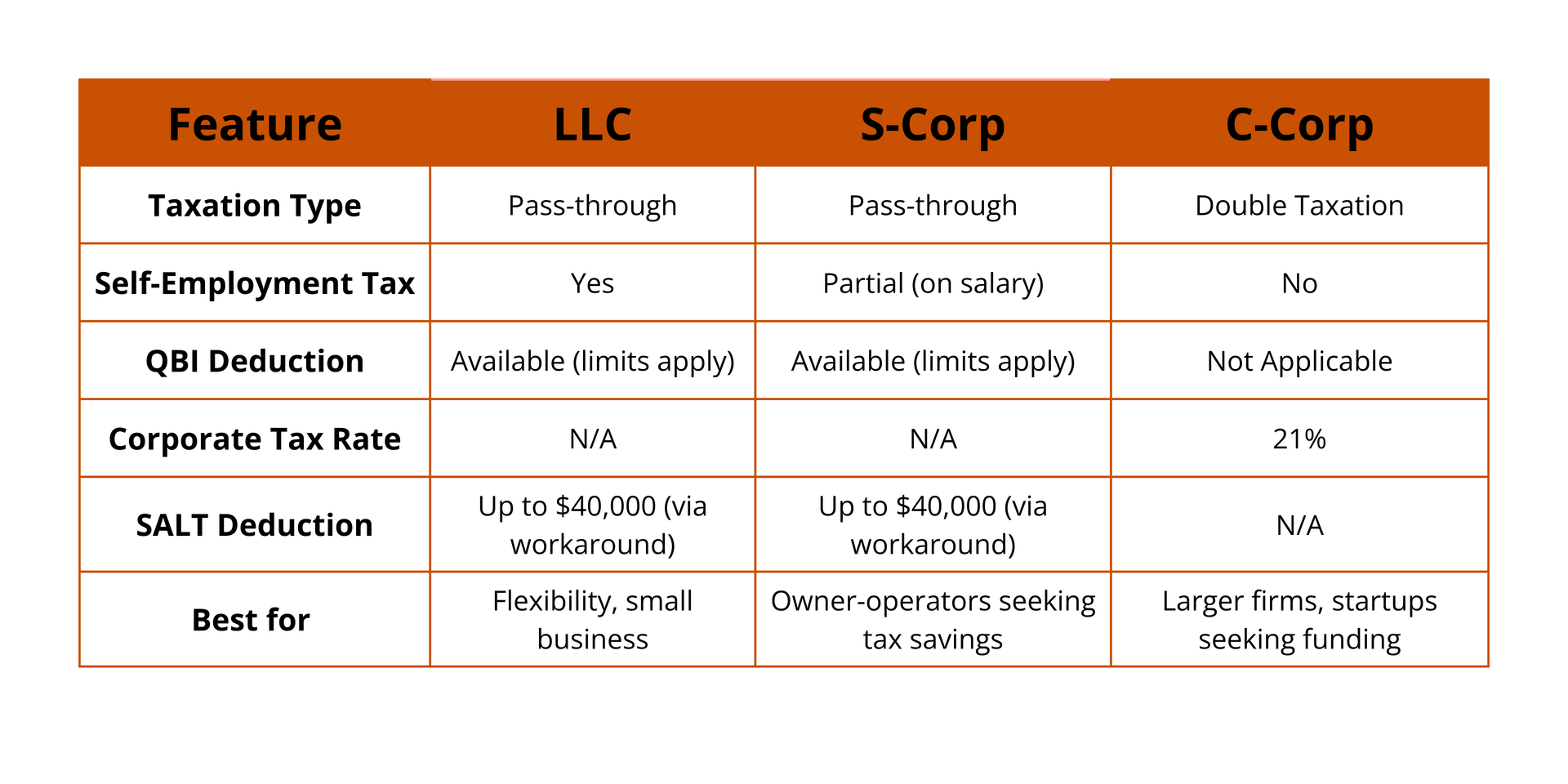

2025 Business Entity Comparison Snapshot:

Which Entity Makes Sense for You in 2025?

Here’s the truth: There’s no one-size-fits-all answer.

● If you’re a solo business owner or freelancer, an LLC with or without S-Corp election may work best for simplicity and tax efficiency.

● If you want to reduce self-employment taxes and are okay with strict payroll rules, an S-Corp may save you money.

● If you're building a scalable company, reinvesting profits, or seeking investors, the C-Corp structure can offer unique tax benefits and funding flexibility.

Final Thoughts:

The new 2025 tax rules are reshaping the landscape for LLCs, S-Corps, and C-Corps alike.

Staying proactive—rather than reactive—could mean thousands saved at tax time.

Whether you're starting fresh or considering an entity switch, now is the time to:

● Review your tax situation

● Reassess your goals

● Align your business structure with your future plans

Need Help Navigating These Changes?

At Otterz, we help business owners like you make smart tax decisions that fuel growth.

Let’s chat and simplify your taxes today!

Found this valuable? Share it with your friends and colleagues!