Expense Management for Small Businesses: Company Expenses List

In this Article:

- A Guide to Efficient Expense Tracking

- Scaling With Your Company Expenses List

- Clarifying Your Financial Picture

- Streamlining Employee Reimbursements

- Preventing Employee Card Abuse

- Modernizing Expense Reports

- Expanding Your Company Expenses List Management

- Conclusion

A Guide to Efficient Expense Tracking

For small businesses, managing expenses isn't just about keeping the lights on; it's a strategic aspect of financial health and growth. However, without an effective expense management system, businesses often find themselves entangled in manual processes, relying on paper receipts that are prone to being lost or mishandled. As your business scales, the complexity and volume of managing a comprehensive company expenses list can become overwhelming, leading to inaccuracies that impact your bottom line. Here's how an expense management solution can streamline your operations and why it's essential for managing your company expenses list efficiently.

1. Scaling With Your Company Expenses List

As your business and workforce expand, so does your company expenses list. An automated expense management solution simplifies tracking these growing expenses, from office supplies to travel expenditures. By digitizing your company expenses list, you reduce paperwork and free up valuable resources, enabling a focus on strategic growth rather than administrative tasks.

2. Clarifying Your Financial Picture

Underestimating the importance of meticulously tracking your company expenses list can cloud your financial insights. Knowing where every dollar goes, from client dinners to sponsorships at local events, is crucial for evaluating return on investment (ROI) and making informed decisions. A robust expense management system provides a clear overview of your spending, highlighting areas that may require additional investment or cost-cutting measures.

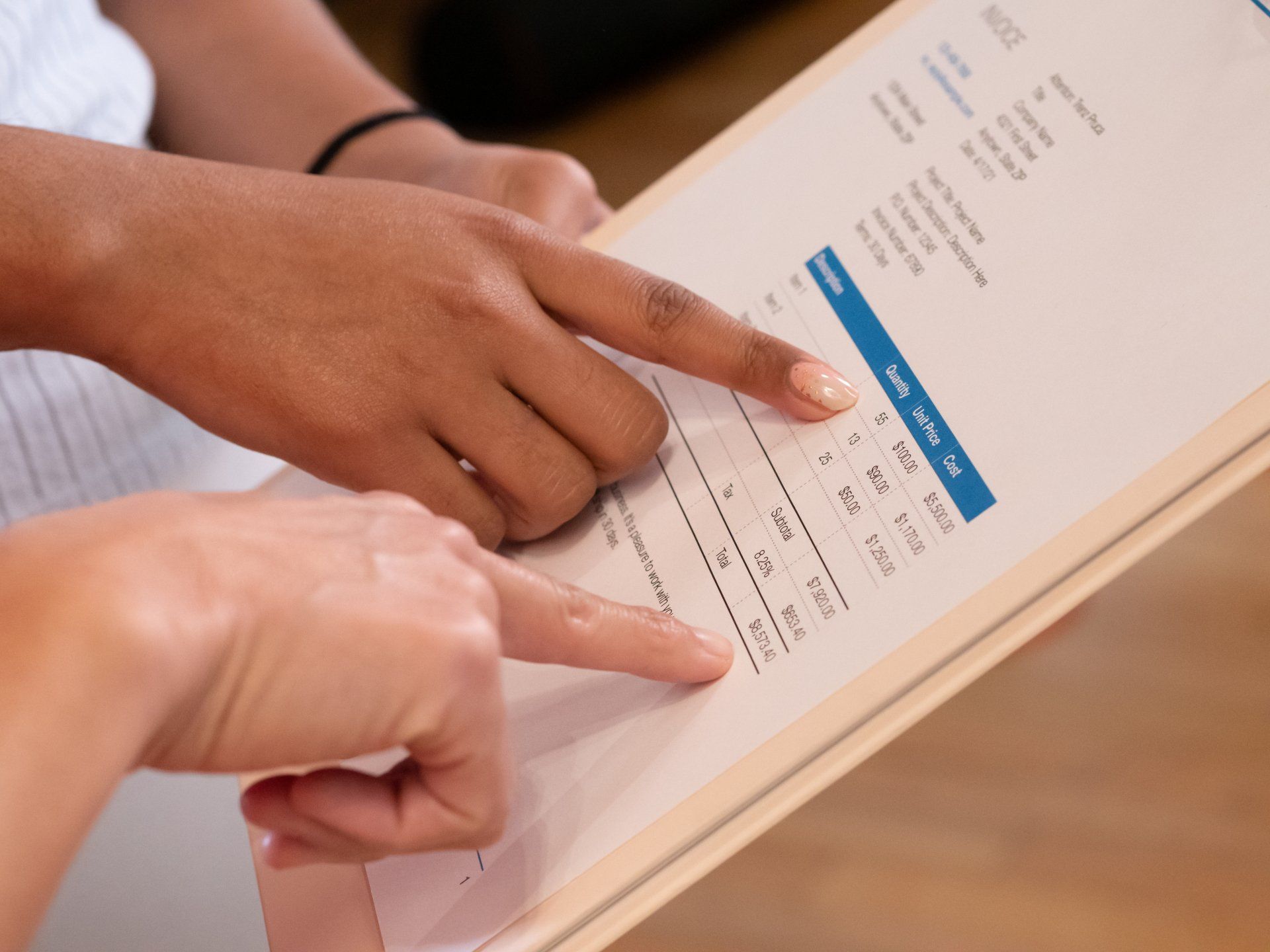

3. Streamlining Employee Reimbursements

Managing reimbursements can be cumbersome, especially for small businesses with a growing team. Implementing an expense management solution not only expedites the reimbursement process but also ensures accuracy and satisfaction among employees. This shift towards digital approvals and payments directly from mobile devices means spending less time on manual reimbursements and more on driving business success.

4. Preventing Employee Card Abuse

To mitigate the risk associated with cash reimbursements and lost receipts, an expense management system offers transparency and control over business spending. This system allows employees to report expenses efficiently while providing employers with real-time visibility into transactions, ensuring adherence to budgetary guidelines and preventing misuse.

5. Modernizing Expense Reports

Transitioning to automated, streamlined expense reporting software keeps everyone in the loop—employees, bookkeepers, and managers alike. With all data securely stored online, accessing and reviewing expense reports becomes effortless, reducing the administrative burden and allowing your team to focus on core business activities.

Expanding Your Company Expenses List Management

In today's competitive landscape, small businesses must adopt strategies that foster efficiency and growth. Managing your company expenses list through traditional methods is no longer viable. By leveraging modern expense management solutions, businesses can gain comprehensive insights into their spending patterns, identify opportunities for savings, and ensure compliance with financial policies.

Furthermore, integrating your expense management with accounting software enriches your financial ecosystem, providing a seamless flow of data and enhancing overall financial health. This integration simplifies reconciling expenses, preparing for tax season, and forecasting future financial needs.

Conclusion

Effective management of your company expenses list is foundational to the success of small businesses. By embracing advanced expense management solutions, businesses can not only streamline their financial operations but also unlock strategic insights that drive informed decision-making and sustainable growth. As you navigate the complexities of expense management, remember that the right tools and practices can transform this challenge into an opportunity for optimization and expansion.

Ready to switch to our small business accounting services?

Disclaimers

- Payment Processing:

- Our "Meet or Beat" any payment processing fees guarantee offers clients standard rates of approx. 2.30% + $0.30 for the Pro Package and Interchange + 0.10% + $0.30 for the Elite and Enterprise Packages. Should a client provide evidence of a competitor offering a more favorable rate under comparable service conditions, Otterz commits to either match or surpass that rate, subject to case-by-case evaluation based on the specific business scenario. This guarantee requires verification of the competitor’s offer, ensuring a fair and accurate comparison, and Otterz reserves the right to determine the applicability of offers for this promise.

- All trademarks, service marks, and trade names referenced in this material are the property of their respective owners. The CardConnect name and logo are owned by CardConnect Corp., a wholly-owned subsidiary of First Data Corporation. CardConnect is a registered ISO of Wells Fargo Bank, N.A., Concord, CA., and Synovus Bank, USA, Columbus, GA. The Clover name and logo are trademarks owned by Clover Network, Inc., a wholly-owned subsidiary of First Data Corporation, and registered or used in the U.S. and many foreign countries.

- Tax: Tax accounting services are provided as part of our Elite and Enterprise Packages without additional charges, specifically covering tasks associated with tax filing preparation and submission. This inclusion aims to offer a comprehensive financial solution, simplifying our clients' tax-related processes. It is important to note that while tax filing fees are effectively reduced to $0 under these packages, clients remain responsible for any tax liabilities or obligations as determined by law. The provision of tax accounting services does not imply liability for inaccuracies, omissions, or compliance issues which may arise. Clients should ensure that all financial information is complete and accurate before submission. This offer enhances the value of our Elite and Enterprise Packages by integrating essential tax accounting services, thereby facilitating potential savings on external tax preparation and filing expenses.

- Bookkeeping: The savings calculations presented are based on comparisons with general industry standards for bookkeeping services at the national level in the United States. For our most affordable package, a 50% savings is calculated against the average cost of part-time bookkeeping services, which ranges from $400 to $800 per month as reported by Freshbooks in 2023. The approximately 74% savings for our highest-priced package is derived by comparing it to the median annual pay of an in-house bookkeeper, $45,860 (translating to $3,821.67 per month), as reported by the U.S. Bureau of Labor Statistics in 2022, and does not factor in additional employment costs such as benefits.

- It's important to note that our services extend beyond basic bookkeeping to include Tax Accounting, Payment Processing, and access to our comprehensive web, Android, and iOS financial management platform, which incorporates Artificial Intelligence Technology. This platform provides analytics data, allows direct chat with a dedicated accountant, and starting in April, will offer access to Nyra, the world's first AI "Accountant". This comparison assumes basic bookkeeping services and may not directly correlate with the enhanced value and broader scope of services we provide.

- Savings are based on general market research and are not a guarantee for every individual scenario. Tailoring services to specific needs may affect pricing and, consequently, the savings percentage.

- By choosing our services, clients not only benefit from potential cost savings but also gain access to a suite of advanced services that enhance their financial management capabilities.