The Hidden Red Flags in Your Books—and How to Catch Them

Unlock Business Growth Through Financial Awareness

Even profitable businesses can face financial trouble. Strong revenue doesn’t always mean strong financial health. If cash flow is unpredictable, bills go unpaid, or your financial reports are disorganized, these are all early warning signs that something deeper could be wrong.

The best defense is awareness. Keeping a close eye on your financials—especially your cash flow, debt levels, and key performance metrics—can help you spot trouble long before it causes real damage. With the right tools and strategies, you can shift from reactive to proactive financial management.

1. Inconsistent Cash Flow: A Silent Threat

One of the most common red flags for small business owners is inconsistent cash flow. Maybe your sales are steady, but you still find yourself struggling to cover payroll or rent. That’s a clear sign that your cash inflows and outflows aren’t aligned.

Poor cash flow often stems from slow-paying clients, unexpected expenses, or simply not tracking finances closely enough. Over time, this can lead to late payments, mounting debt, and missed growth opportunities.

To prevent this, it’s critical to regularly monitor your cash flow—not just monthly, but ideally on a weekly basis. Setting up systems for faster invoicing and more predictable payments can also go a long way in stabilizing your finances.

2. Rising Debt Without a Clear Repayment Plan

Another issue that often flies under the radar is an overreliance on credit to fund operations. Whether it’s business credit cards, short-term loans, or lines of credit, borrowing without a plan to pay it back can quickly lead to a dangerous debt spiral.

If you’re using debt to cover day-to-day expenses, it’s a strong indicator that your business model needs adjustment. Interest payments can pile up fast, draining your cash reserves and limiting your ability to invest in growth.

The solution isn’t just cutting costs—it’s creating a plan. This means understanding where your money is going, refinancing when possible, and setting realistic timelines to reduce what you owe. Working with a financial advisor or accountant can help you build a smart, sustainable debt management strategy.

3. Shrinking Margins and What They Mean

Have you ever noticed that even though your sales are up, your profits are down? That’s a red flag. When costs increase—whether it’s materials, rent, or payroll—but pricing stays the same, your margins shrink. Over time, this can leave your business spinning its wheels without generating real returns.

Many business owners don't regularly analyze their profit margins or understand which products or services are profitable. Without this clarity, it’s easy to make decisions that seem beneficial but hurt your bottom line.

Evaluating your pricing strategy, negotiating better rates with suppliers, and cutting inefficiencies can help restore balance. Focus on what's working, eliminate what’s not, and regularly review financial metrics like gross and net profit margins.

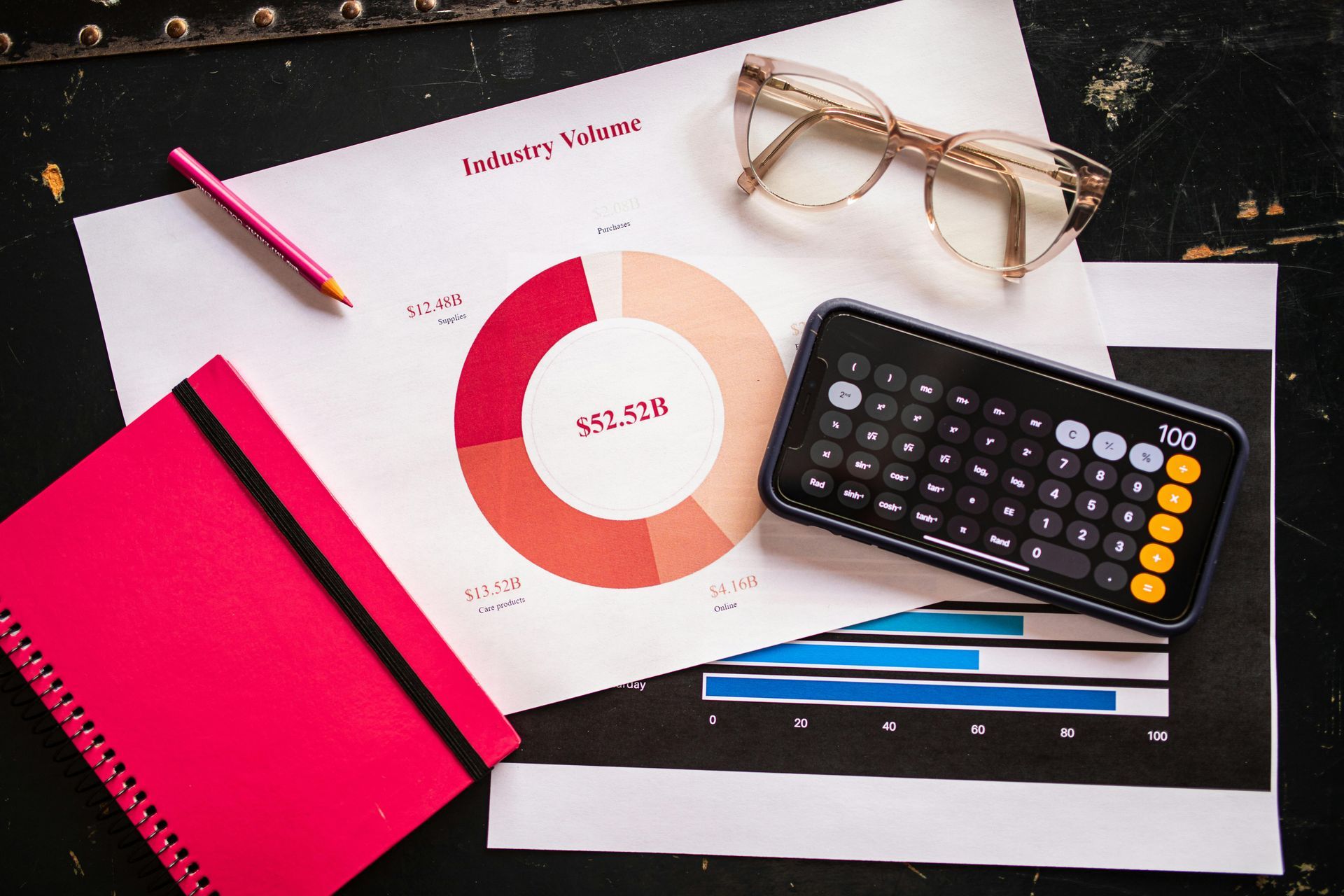

4. The Danger of Ignoring Your Financial Reports

Let’s be honest—most entrepreneurs didn’t start their businesses to become financial analysts. But avoiding your financial statements is like driving a car with your eyes closed. If you don’t know what’s coming in, what’s going out, and where you stand, you’re just guessing.

Many businesses get into trouble simply because they don’t reconcile bank statements, review income statements, or monitor accounts receivable and payable. This opens the door to missed payments, accounting errors, and even fraud.

You don’t have to do it all yourself. Using accounting software or working with a professional bookkeeper can give you the clarity you need to make smart, confident decisions. At a minimum, set aside time each month to review your reports and spot any unusual trends.

5. Too Much Dependence on Too Few Clients

If one or two clients make up the bulk of your revenue, your business could be at risk even if those clients are currently reliable. Should they leave, pause services, or reduce spending, your entire financial foundation could be shaken.

Client concentration issues can be hard to spot when things are going well, but the risk is real. That’s why diversifying your client base and regularly bringing in new leads is so important.

Don’t wait for a major client to pull out before acting. Instead, invest in marketing, nurture your sales pipeline, and work to ensure that no single client accounts for more than 20–30% of your revenue.

Final Thoughts: Be Proactive, Not Reactive

Financial red flags aren’t always obvious, but they are always important. The earlier you catch them, the easier they are to fix. By paying close attention to your financials, using modern accounting tools, and seeking expert advice when needed, you can avoid small issues turning into major setbacks.

Think of financial management as more than just bookkeeping—it’s the foundation of every decision you make in your business. When your finances are strong, your business is more resilient, more agile, and better equipped for growth.

Need Help Getting Your Financial House in Order?

At OTTERZ, we help business owners like you spot financial red flags early and create strategies that lead to long-term success. Whether you need help with cash flow, accounting, or financial planning, we’re here to help.

📅 Schedule a free consultation today and get clarity on your next financial steps.

Found this valuable? Share it with your friends and colleagues!