The Accounting Industry is Ripe for Disruption — USING AI

The future of accounting using AI

The Status Quo Is Obsolete...

The Status Quo Is Obsolete

Traditional accounting firms operate on a century-old model:

- Billable hours, not outcomes. Time-based pricing still dominates.

- Leverage-driven profits. Senior accountants rely on juniors for volume.

- Manual work is glorified. Endless reconciliations, journal entries, amortizations.

- Hierarchy over speed. Decisions and execution are bogged down by layers.

Firms like Deloitte, PwC, and EY charge $500-$1000+/hour for work that is increasingly automatable.

But:

- Their rates reflect brand, not always efficiency.

- Their processes are bloated and paper-heavy.

- They resist transformation because their model depends on manual leverage.

Technology Spend Is Minimal

- Accounting firms spend <2% of revenue on tech.

- Meanwhile, fintech startups and banks are building real-time finance infrastructure.

Why? Because the Big Four model incentivizes complexity — not simplicity.

AI Is Attacking the Core of Accounting

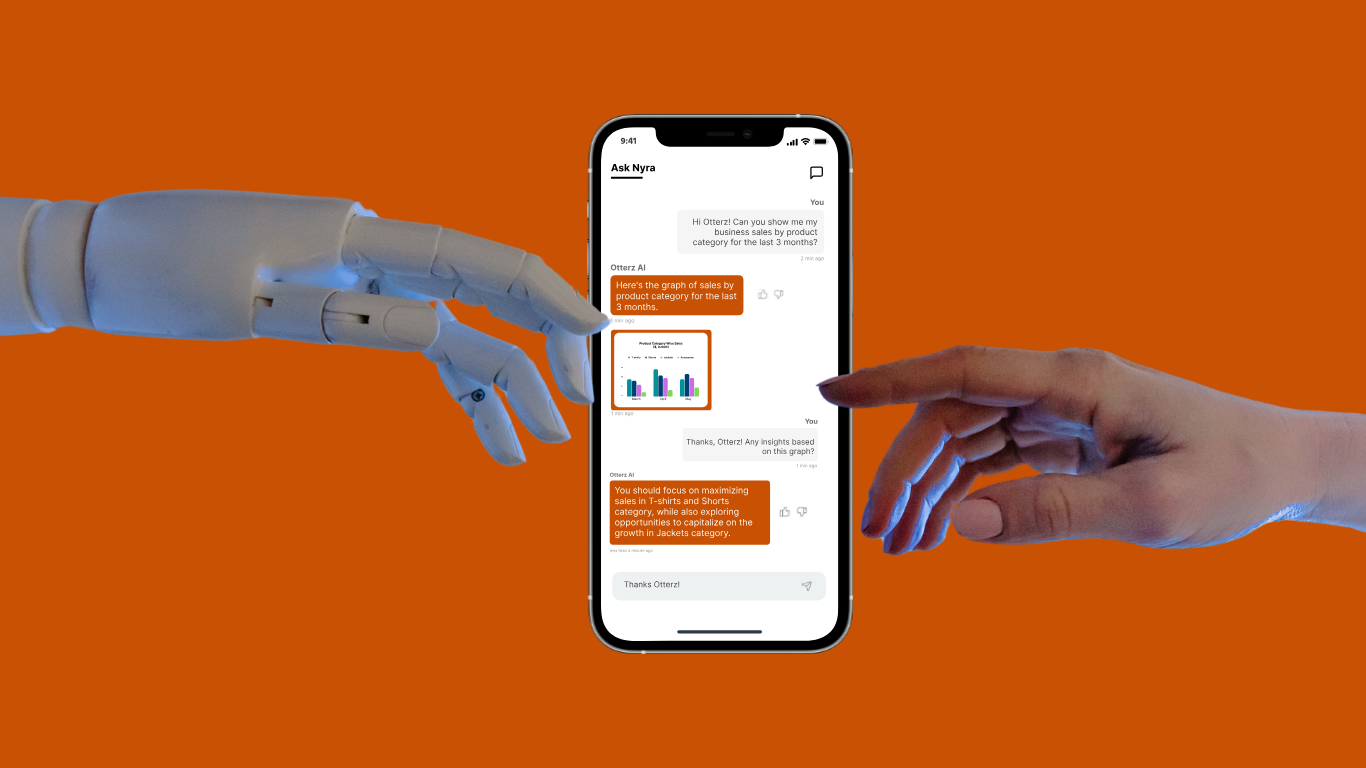

Otterz is positioning itself as the “new firm model” — built around AI, speed, and outcomes:

AI is already reshaping accounting:

- Automated categorization: No need for monthly bookkeeping grunt work.

- Reconciliations at scale: AI identifies mismatches instantly.

- Dynamic close: Month-end becomes real-time.

- Tax planning: Modeled and forecasted instantly.

- CFO insights: AI-powered dashboards replace armies of analysts.

Just like AI handles legal research and contract drafting, it now handles bookkeeping, reporting, and compliance.

The $10,000/Hour Accountant Isn’t Who You Think

It won’t be today’s partner at a Big Four firm charging more.

It will be the lean operator, empowered by AI, providing:

- Real-time visibility

- Automated compliance

- Strategic insights at scale

They’ll build AI-native firms that deliver more value, with fewer people, faster.

Just like law, the accounting firms of the future:

- Won’t have 100-person teams for monthly close.

- Won’t charge $800/hr for spreadsheet work.

- Will operate with 5-10x efficiency.

- Will focus on insights, not inputs.

Otterz = The AI-Native Accounting Firm

Here is what our clients say about us:

“Otterz is building what the Big Four won’t: a fast, affordable, AI-native accounting firm that replaces complexity with clarity.”

“The future of accounting isn’t more people. It’s smarter systems.”

“Not just faster books. Smarter decisions.”

Playbook: How AI Native firms can win

- Target disillusioned accountants who want to do more strategic work.

- Offer firms a migration path from people-heavy workflows to AI-powered ones.

- Appeal to CFOs and founders who are tired of $10k monthly bills and slow books.

- Push case studies that show how Otterz closes books 5x faster at 30% of the cost.

- Lead with financial insight, not compliance. You are not just bookkeepers — you are profitability engineers.

Found this valuable? Share it with your friends and colleagues!