Small Business Bookkeeping Services: An Essential Guide

In this Article:

- The Advantage of Full-Service Bookkeeping

- The Foundation of Financial Management: Understanding Bookkeeping Services

- Chart of Accounts: Tailoring Your Financial Framework

- Maximizing Efficiency with Advanced Bookkeeping Software

- Leveraging AI in Bookkeeping: The Future of Financial Management

- Comprehensive Income and Expense Tracking

- Bank Reconciliation: Ensuring Accuracy and Integrity

- Managing Cashflow: Accounts Receivables and Payable

- Tax Reporting and Compliance: A Strategic Approach

- The Full-Service Bookkeeping Solutions with a dedicated accountant offered by Otterz

The Advantage of Full-Service Bookkeeping

Effective bookkeeping services are the cornerstone of financial health and success for businesses of all sizes. From small startups to medium-sized enterprises, maintaining accurate financial records is crucial for compliance, decision-making, and strategic planning. This comprehensive guide delves into the essential aspects of bookkeeping services, offering insights and practical examples to help businesses navigate the complexities of financial management.

The Foundation of Financial Management: Understanding Bookkeeping Services

Bookkeeping services extend beyond mere transaction recording to encompass a suite of financial management solutions designed to support business growth. These services include, but are not limited to, daily transaction categorization, financial statement preparation, payroll processing, and tax planning and filing. By leveraging full-service bookkeeping, businesses gain a strategic partner capable of offering tailored advice based on a deep understanding of their financials.

Chart of Accounts: Tailoring Your Financial Framework

The chart of accounts is a framework that categorizes and organizes your business's financial transactions. It typically includes categories such as assets, liabilities, equity, revenue, and expenses. By properly structuring your chart of accounts, you can track income and expenses accurately and gain valuable insights into your business's financial performance.

A well-structured chart of accounts is critical for accurately categorizing financial transactions, which in turn, is vital for generating insightful financial reports. A customized chart of accounts reflects the unique aspects of a business, ensuring a clear view of financial performance and aiding in strategic decision-making.

Maximizing Efficiency with Advanced Bookkeeping Software

The strategic implementation of advanced bookkeeping software stands as a cornerstone for achieving operational efficiency and financial clarity. Platforms like QuickBooks, Xero, Sage, and FreshBooks are at the forefront of this transformation, offering a suite of features designed to automate and streamline the complexities of bookkeeping.

QuickBooks: Renowned for its user-friendly interface, QuickBooks simplifies financial management for businesses of all sizes. It offers comprehensive features for tracking expenses, managing invoices, processing payroll, and generating detailed financial reports. Its ability to integrate with a multitude of third-party apps and services allows businesses to create a customized bookkeeping solution that fits their unique needs.

Xero: Xero is celebrated for its robust cloud-based platform, enabling businesses to access their financial data anytime, anywhere. It excels in real-time financial tracking and collaboration, making it ideal for businesses looking to maintain up-to-date records and work seamlessly with their accountants and financial teams. Xero's extensive ecosystem of add-ons enhances its functionality, allowing for tailored solutions in inventory management, time tracking, and more.

Sage: Sage offers a range of bookkeeping and accounting solutions tailored to different business sizes and industries. Its software is designed to manage accounting, payroll, payments, and enterprise resource planning (ERP) within a single system. Sage's strength lies in its scalability, providing tools that grow with your business, from startup to enterprise level.

FreshBooks: Specifically designed with small business owners and freelancers in mind, FreshBooks offers an intuitive and straightforward approach to bookkeeping. It specializes in invoicing, expense tracking, time tracking, and project management. Its simple yet powerful platform makes financial management accessible, even for those with minimal accounting knowledge.

- Automation and Integration: One of the key advantages of these advanced bookkeeping software solutions is their ability to automate repetitive tasks such as transaction recording, invoice generation, and even bank reconciliation. This automation reduces the likelihood of human error and frees up valuable time that can be redirected towards strategic financial planning and business growth. Moreover, these platforms offer extensive integration capabilities, connecting seamlessly with bank accounts, payment processors, CRM systems, and other critical business tools. This integration provides a holistic view of a business's financial health, facilitating informed decision-making and strategic planning.

- Customization and Scalability: Another significant benefit is the customization and scalability these software solutions offer. Businesses can tailor the software to meet their specific needs, whether it's customizing invoices, setting up specific financial reporting, or scaling the software as the business grows. This flexibility ensures that the bookkeeping software remains a valuable asset, regardless of the business's stage of development.

- Security and Compliance: With the increasing importance of data security, advanced bookkeeping software provides robust security measures to protect sensitive financial information. Encryption, multi-factor authentication, and regular security audits are standard features, ensuring that financial data is secure and compliant with relevant regulations.

Leveraging AI in Bookkeeping: The Future of Financial Management

The advent of artificial intelligence (AI) in bookkeeping marks a transformative shift in how businesses manage their finances. AI bookkeeping tools are designed to automate complex, time-consuming tasks that traditionally required manual intervention, such as transaction categorization, invoice processing, and even anomaly detection in financial records. These intelligent systems learn from patterns in data, enabling them to improve efficiency and accuracy over time.

AI-driven bookkeeping solutions can analyze large volumes of transactions almost instantaneously, providing businesses with real-time insights into their financial health. This allows for more dynamic decision-making and strategic planning. Furthermore, AI enhances the accuracy of financial forecasts, budgeting, and tax preparation by identifying trends and predicting future financial outcomes with a high degree of precision.

The integration of AI into bookkeeping not only streamlines operational efficiencies but also opens up new avenues for strategic financial management. Businesses can now access predictive analytics and insights that were previously difficult or impossible to obtain. This shift towards AI-driven financial management empowers businesses to stay ahead of the curve, adapting more quickly to market changes and identifying opportunities for growth and optimization.

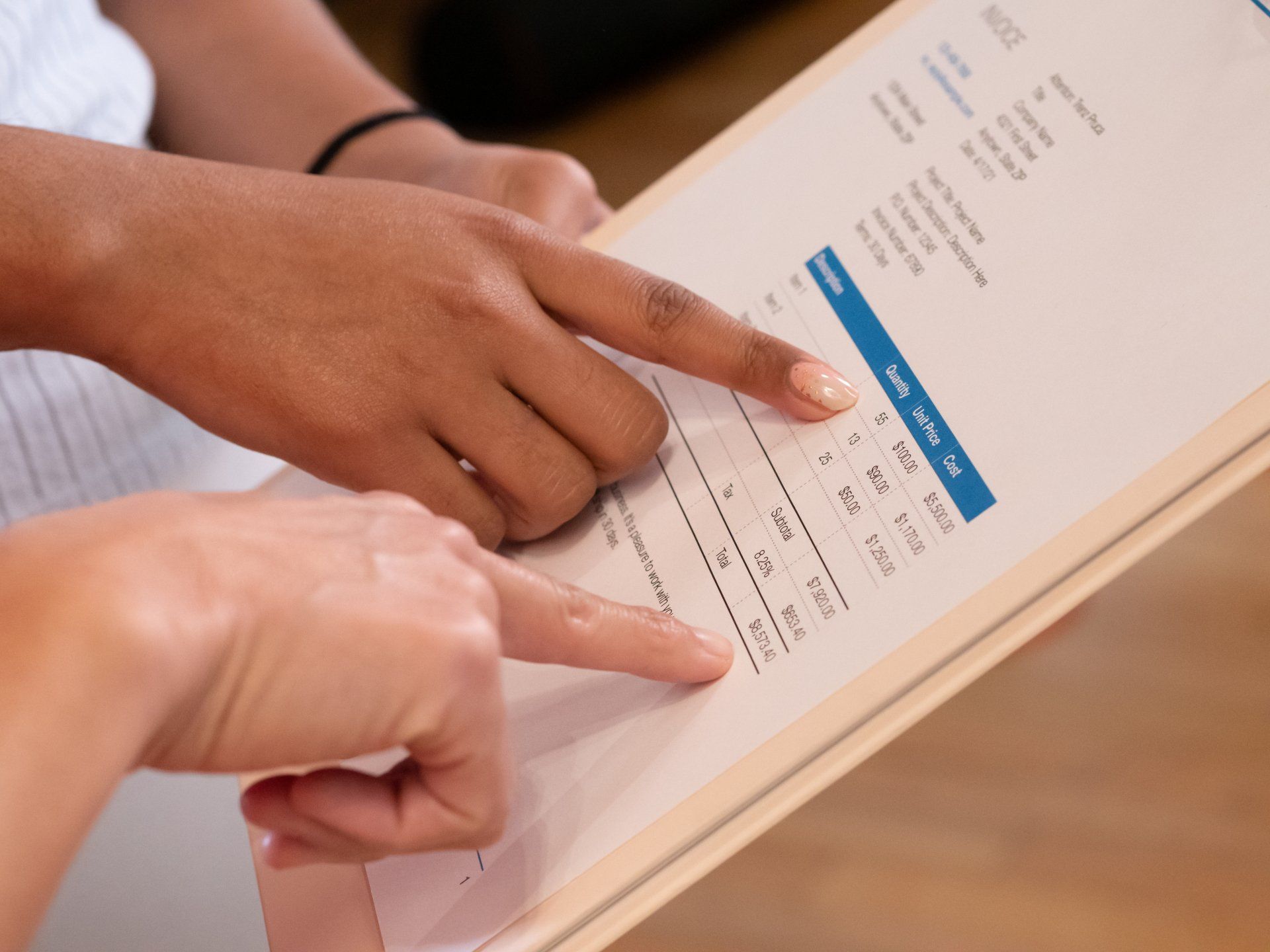

Comprehensive Income and Expense Tracking

This process goes beyond the mere recording of transactions; it involves a systematic approach to capturing every financial interaction with precision, providing the foundation for deep financial analysis and strategic decision-making.

- Precision in Data Entry: The first step towards comprehensive income and expense tracking is ensuring the accuracy of data entry. Every invoice, receipt, bank transaction, and financial event must be recorded systematically. This level of detail not only helps in maintaining accurate books but also aids in identifying discrepancies early, allowing for timely corrections.

- Categorization for Clarity: Categorizing transactions into meaningful groups such as revenue, cost of goods sold, payroll expenses, and operating expenses is crucial. This categorization facilitates an organized analysis of financial data, enabling businesses to see exactly where money is coming from and where it is going. By analyzing these categories, businesses can identify areas of high expenditure, uncover potential savings, and make informed decisions about where to allocate resources for growth.

- Regular Review and Reconciliation: To ensure the integrity of financial records, regular review and reconciliation of accounts should be conducted. This involves matching recorded transactions against bank statements and other financial documents to confirm accuracy. Regular reconciliation helps in identifying and resolving discrepancies, preventing financial misstatements, and ensuring that the books accurately reflect the business's financial status.

- Utilizing Technology for Efficiency: Leveraging technology, such as bookkeeping and accounting software, can significantly enhance the efficiency and accuracy of income and expense tracking. Many modern software solutions offer features like automatic transaction import from bank accounts, categorization using AI, and real-time financial reporting. These tools not only save time but also reduce the risk of human error, making the tracking process more reliable.

- Insights for Strategic Decision-Making: The ultimate goal of comprehensive income and expense tracking is to provide actionable insights for strategic decision-making. By having a clear understanding of financial performance, businesses can make data-driven decisions regarding investment, cost-cutting, pricing strategies, and business expansion. For instance, trend analysis might reveal seasonal variations in revenue, informing marketing and sales strategies to capitalize on peak periods and mitigate downturns.

- Enhancing Profitability through Optimization: With detailed financial data, businesses can undertake a granular analysis of profitability by product line, service offering, or business segment. This analysis can uncover underperforming areas that require adjustment or highlight successful strategies that can be scaled. Additionally, expense tracking can identify opportunities for negotiations with suppliers or the consolidation of services to achieve cost savings.

Comprehensive income and expense tracking is not just a routine bookkeeping task but a strategic function that underpins effective financial management. By adopting meticulous tracking practices, businesses can ensure financial stability, optimize operations, and position themselves for sustained growth and profitability.

Bank Reconciliation: Ensuring Accuracy and Integrity

Regular bank reconciliation stands as a crucial pillar of financial management, ensuring the accuracy and integrity of a business's financial records. By systematically comparing the transactions recorded in the books with those listed on bank statements, this process serves as a vital checkpoint for identifying discrepancies and safeguarding against financial inaccuracies.

- A Foundation of Trust: Bank reconciliation forms the foundation of trust in a business's financial reporting. By reconciling recorded transactions with bank statements, businesses can validate the accuracy of their financial records and detect any errors or discrepancies that may have occurred during data entry or processing. This verification process instills confidence in stakeholders, including investors, creditors, and regulatory bodies, ensuring transparency and accountability in financial reporting.

- Timely Resolution of Discrepancies: One of the primary benefits of regular bank reconciliation is the prompt identification and resolution of discrepancies. Whether it's a missing transaction, a duplicate entry, or a banking error, reconciling accounts on a regular basis allows businesses to address issues swiftly, preventing them from snowballing into larger financial discrepancies. This proactive approach not only maintains the integrity of financial records but also minimizes the risk of potential financial losses or misstatements.

- Detection of Fraudulent Activities: Bank reconciliation serves as a critical tool for detecting and preventing fraudulent activities within an organization. Discrepancies between recorded transactions and bank statements may indicate unauthorized withdrawals, fraudulent charges, or accounting irregularities. By conducting thorough reconciliation processes, businesses can identify anomalies early and implement measures to mitigate the risk of fraud, safeguarding their financial assets and reputation.

- Enhanced Decision-Making: Accurate and up-to-date financial information is essential for informed decision-making. By ensuring the accuracy of financial records through bank reconciliation, businesses can make strategic decisions with confidence, based on reliable data. Whether it's evaluating investment opportunities, managing cash flow, or planning for future growth, access to accurate financial information empowers businesses to navigate challenges and seize opportunities effectively.

Bank reconciliation is not just a routine financial task but a critical process that ensures the accuracy, integrity, and trustworthiness of a business's financial records. By conducting regular reconciliation exercises, businesses can maintain transparency, detect and resolve discrepancies promptly, and make informed decisions that drive sustainable growth and success.

Managing Cash Flow: Accounts Receivable and Payable

Efficient management of accounts receivable and payable lies at the heart of maintaining a healthy cash flow, which is essential for the sustainability and growth of any business. By effectively managing the inflow and outflow of funds, businesses can ensure smooth operations, meet financial obligations, and seize opportunities for expansion.

- Accounts Receivable Management: Timely invoicing and diligent follow-up on outstanding payments are paramount for managing accounts receivable. Businesses must establish clear credit terms, communicate payment expectations upfront, and send invoices promptly upon completion of goods or services. Implementing automated reminders for overdue invoices can help expedite the collection process, ensuring that funds are received in a timely manner. Furthermore, analyzing accounts receivable aging reports allows businesses to identify overdue accounts early and take proactive measures to minimize bad debt and improve cash flow.

- Accounts Payable Management: On the other side of the equation, managing accounts payable involves overseeing the timely payment of bills and invoices to suppliers and vendors. Establishing efficient payment processes, such as implementing electronic payment systems or setting up recurring payments for recurring expenses, can streamline the accounts payable process and ensure that payments are made on time. Negotiating favorable payment terms with suppliers, such as extended payment terms or early payment discounts, can also help optimize cash flow and improve relationships with vendors.

- Strategic Cash Flow Planning: Effective cash flow management goes beyond simply managing accounts receivable and payable; it requires strategic planning and forecasting to anticipate and mitigate cash flow fluctuations. Businesses should develop cash flow projections based on historical data, sales forecasts, and anticipated expenses to identify potential cash shortfalls or surpluses. By understanding their cash flow needs in advance, businesses can take proactive measures to address liquidity challenges, such as securing additional financing or adjusting payment schedules, and capitalize on opportunities for investment or expansion during periods of surplus cash.

- Building Strong Relationships: Efficient management of accounts receivable and payable not only improves cash flow but also fosters strong relationships with customers and suppliers. By honoring payment commitments and communicating transparently with stakeholders, businesses can build trust and credibility, leading to mutually beneficial partnerships and long-term success.

Effective management of accounts receivable and payable is essential for maintaining healthy cash flow and driving business growth. By implementing best practices for invoicing, payment processing, and cash flow planning, businesses can optimize their financial operations, mitigate risks, and capitalize on opportunities for success.

Tax Reporting and Compliance: A Strategic Approach

Navigating the complexities of tax reporting and compliance requires expertise, meticulous attention to detail, and strategic planning. Businesses must stay abreast of ever-changing tax laws and regulations while ensuring accurate and timely reporting to meet their tax obligations effectively. A strategic approach to tax reporting and compliance involves leveraging specialized knowledge, maintaining detailed records, and maximizing deductions and credits to minimize tax liabilities.

- Expertise in Tax Laws and Regulations: Tax laws and regulations are continually evolving, making it essential for businesses to stay informed and compliant. Engaging the services of experienced tax professionals or partnering with a full-service bookkeeping provider with expertise in tax planning and preparation can help businesses navigate the complexities of the tax landscape. These professionals stay updated on changes in tax laws, identify relevant deductions and credits, and ensure compliance with filing deadlines, reducing the risk of penalties and audits.

- Detailed Record-Keeping: Maintaining detailed records of income, expenses, deductions, and credits is critical for accurate tax reporting and compliance. Robust bookkeeping practices, supported by advanced accounting software, enable businesses to track financial transactions systematically and generate comprehensive financial reports that serve as a basis for tax preparation. By organizing and documenting financial data throughout the year, businesses can streamline the tax preparation process and minimize the risk of errors or omissions when filing taxes.

- Strategic Tax Planning: Strategic tax planning involves proactively managing tax liabilities and optimizing tax outcomes through careful planning and analysis. By understanding the tax implications of business decisions, such as investment strategies, asset purchases, and organizational structures, businesses can minimize tax liabilities and maximize tax savings opportunities. Strategic tax planning may involve utilizing tax-efficient investment vehicles, structuring transactions to maximize deductions, and leveraging available tax credits and incentives to reduce overall tax burdens.

- Maximizing Deductions and Credits: Identifying and maximizing deductions and credits is a key component of effective tax planning. Businesses should take advantage of all available deductions and credits, such as business expenses, depreciation, research and development credits, and investment incentives, to reduce taxable income and lower tax liabilities. By leveraging specialized knowledge and expertise, businesses can optimize their tax positions and retain more of their hard-earned profits for reinvestment and growth.

- Compliance and Filing: Compliance with tax laws and regulations is non-negotiable for businesses of all sizes. Filing accurate and timely tax returns, including income tax, sales tax, payroll tax, and other applicable taxes, is essential to avoid penalties, interest, and legal repercussions. Partnering with a reputable tax professional or full-service bookkeeping provider can help ensure compliance with tax filing requirements, including proper documentation, record retention, and adherence to filing deadlines.

A strategic approach to tax reporting and compliance is essential for businesses seeking to minimize tax liabilities, mitigate risks, and maintain compliance with ever-changing tax laws and regulations. By leveraging specialized knowledge, maintaining detailed records, and maximizing deductions and credits, businesses can optimize their tax positions and focus on achieving their long-term financial goals.

Otterz's All-in-One Small Business Accounting Solutions with Dedicated Small Business CPAs

Otterz offers a suite of Small Business Accounting Solutions designed specifically for the unique challenges faced by small businesses. We go beyond basic bookkeeping by providing a complete array of financial services tailored to streamline your operations, enhance decision-making, and foster growth.

Tailored Payment Processing Solutions: Otterz delivers advanced payment processing for online and in-person transactions. We offer Clover and Cardpointe Payment Processing Solutions, tailored to fit the specific needs of your business, ensuring smooth transactions and efficiency.

Access to Strategic Financial Insights through Innovative Digital Tools: Our exclusive financial management platform, accessible via web, Android, and iOS, allows for seamless communication with your personal accountant. It offers detailed reports and analytics for a comprehensive financial overview, integrating data across all bank accounts and accounting software. This enables informed decision-making. Regular communication through the Otterz Platform ensures you receive timely support and professional advice whenever you need it.

Expert Tax Planning and Preparation: Our experienced team provides strategic tax planning and preparation services. We delve into your financial details to develop effective tax strategies, aiming for meticulous filing while maximizing deductions and credits to minimize your tax liabilities. Partnering with Otterz gives you access to personalized tax advice, tailored to your business needs.

The Advantage of Comprehensive Accounting Packages: Otterz's Small Business Accounting Solutions consolidate transaction management, strategic tax planning, and a broad spectrum of financial services. This integrated approach offers significant value and efficiency compared to standalone services. Our focus on accuracy, reliability, and cost-effectiveness ensures premium service that fits your budget.

Enhanced Decision-Making with Nyra - the World's First AI Accountant: We are committed to integrating the latest technology, including AI, to provide sophisticated financial management tools. Our upcoming AI Accounting features promise to revolutionize expense tracking, cash flow forecasting, business intelligence, and compliance, offering personalized insights based on your business's data. This will enhance decision-making and support your business's growth.

In summary, Otterz redefines small business financial management, serving as a key partner in your pursuit of financial success. Our comprehensive solutions, combined with cutting-edge technology and a commitment to quality, make Otterz the go-to choice for navigating financial complexities of small businesses.

Ready to switch to our small business accounting services?

Disclaimers

- Payment Processing:

- Our "Meet or Beat" any payment processing fees guarantee offers clients standard rates of approx. 2.30% + $0.30 for the Pro Package and Interchange + 0.10% + $0.30 for the Elite and Enterprise Packages. Should a client provide evidence of a competitor offering a more favorable rate under comparable service conditions, Otterz commits to either match or surpass that rate, subject to case-by-case evaluation based on the specific business scenario. This guarantee requires verification of the competitor’s offer, ensuring a fair and accurate comparison, and Otterz reserves the right to determine the applicability of offers for this promise.

- All trademarks, service marks, and trade names referenced in this material are the property of their respective owners. The CardConnect name and logo are owned by CardConnect Corp., a wholly-owned subsidiary of First Data Corporation. CardConnect is a registered ISO of Wells Fargo Bank, N.A., Concord, CA., and Synovus Bank, USA, Columbus, GA. The Clover name and logo are trademarks owned by Clover Network, Inc., a wholly-owned subsidiary of First Data Corporation, and registered or used in the U.S. and many foreign countries.

- Tax: Tax accounting services are provided as part of our Elite and Enterprise Packages without additional charges, specifically covering tasks associated with tax filing preparation and submission. This inclusion aims to offer a comprehensive financial solution, simplifying our clients' tax-related processes. It is important to note that while tax filing fees are effectively reduced to $0 under these packages, clients remain responsible for any tax liabilities or obligations as determined by law. The provision of tax accounting services does not imply liability for inaccuracies, omissions, or compliance issues which may arise. Clients should ensure that all financial information is complete and accurate before submission. This offer enhances the value of our Elite and Enterprise Packages by integrating essential tax accounting services, thereby facilitating potential savings on external tax preparation and filing expenses.

- Bookkeeping: The savings calculations presented are based on comparisons with general industry standards for bookkeeping services at the national level in the United States. For our most affordable package, a 50% savings is calculated against the average cost of part-time bookkeeping services, which ranges from $400 to $800 per month as reported by Freshbooks in 2023. The approximately 74% savings for our highest-priced package is derived by comparing it to the median annual pay of an in-house bookkeeper, $45,860 (translating to $3,821.67 per month), as reported by the U.S. Bureau of Labor Statistics in 2022, and does not factor in additional employment costs such as benefits.

- It's important to note that our services extend beyond basic bookkeeping to include Tax Accounting, Payment Processing, and access to our comprehensive web, Android, and iOS financial management platform, which incorporates Artificial Intelligence Technology. This platform provides analytics data, allows direct chat with a dedicated accountant, and starting in April, will offer access to Nyra, the world's first AI "Accountant". This comparison assumes basic bookkeeping services and may not directly correlate with the enhanced value and broader scope of services we provide.

- Savings are based on general market research and are not a guarantee for every individual scenario. Tailoring services to specific needs may affect pricing and, consequently, the savings percentage.

- By choosing our services, clients not only benefit from potential cost savings but also gain access to a suite of advanced services that enhance their financial management capabilities.